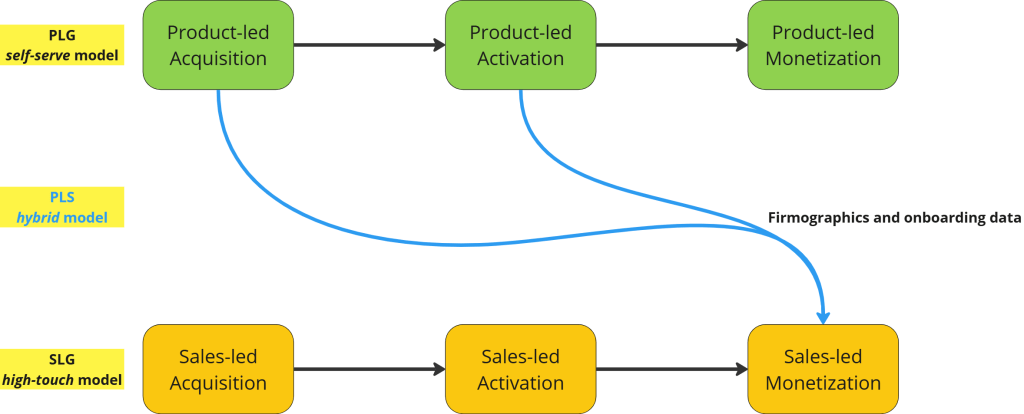

As your product moves upmarket from individual users to SMBs and enterprise accounts, it becomes more important to have a product-led sales (PLS) approach where product insights feed into Sales and Marketing to help more quickly and effectively identify and convert product-qualified accounts (PQAs). PLS is essentially a way to qualify the pipeline of accounts based on their behavior. It helps you decide when to monetize; as your accounts get into the latter customer success stages, they are more likely to monetize with the right support. One fundamental difference between PLG and PLS approaches is while the former focuses on downmarket users, the latter best caters to PQAs and product-qualified leads (PQLs) within upmarket accounts.

Similarly, ICPs for PLS motions tend to be accounts rather than individuals. The same heuristics can be used for identifying and talking to account ICPs – start with the qualitative data then dig into the quantitative, define their use cases over firmographics, and lastly, segment later as needed. First, optimize retention, then conversion, and finally acquisition to prevent a leaky bucket.

PLS timing

When kicking off a PLS motion, a frequently asked question is “When do we employ self-serve vs. high touch?”. This question is especially relevant for products that have previously leveraged PLG motions. PLS aims to find accounts worth contacting when they signal they’re ready for a sales touch through product usage behavior. Therefore, the timing of customer care/sales outreach is critical. Too early or too late, and you may lose them. A classic way to figure out the right time to reach out to accounts is by the following three steps:

- Define a threshold

- Track and verify account signals via a scoring table

- Refine and convert leads that cross the threshold

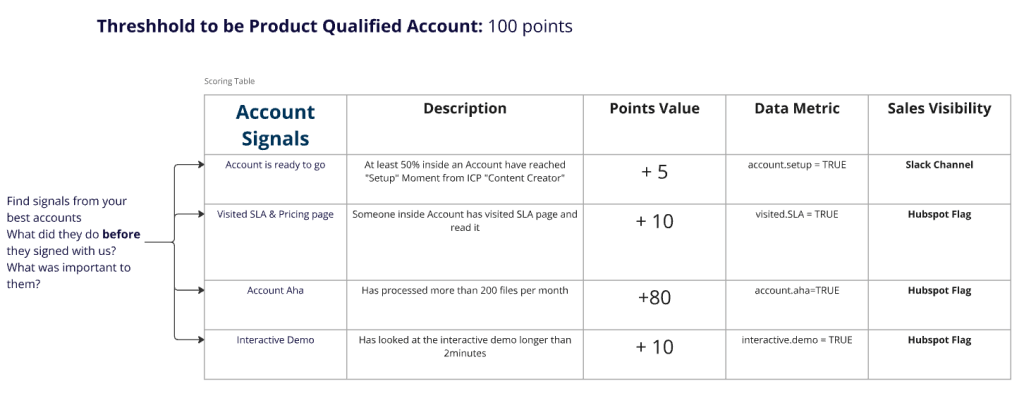

Define an arbitrary threshold that you would like qualified PQAs to reach – start with 100 if you’re unsure. This threshold is a starting point; it should be continuously refined as you gather more data about your ICPs. Then look at past success moments for PQAs and the signals they gave at different stages of their user journey. Include those signals in a scoring table. If your product doesn’t have past data to look at, brainstorm and list the account signals that might indicate you’ve got a qualified PQA with the intent to buy your product. Think around the following two dimensions:

- How much potential do you still have to optimize this metric?

- How “important” or how strong is the signal to indicate a qualified account?

As in the sample scoring table above, you typically want to give a high percentage of the total threshold points to accounts that reach the Aha moment. Remember that the ideal activation rate between the Setup and Aha moments should lie between 30-60%. Defining the “data metric” and “sales visibility” fields in a scoring table are additional good practices to be explicit about the internal data storage and usage process. Vendors such as Pocus (a tool for salespeople to look through product analytics for the right signals for outreach), Correlated, and Endgame.io can all help identify and track detailed account signals.

Once you’ve defined a threshold and the points you’d like to assign to the different moments in the account’s user journey, contact them via sales calls. Track and compare the payback period and LTV of the new PQAs to that of past closed accounts. If the newly qualified accounts demonstrate a low close rate, high CAC, etc. compared to past accounts that converted and monetized, then go back to the drawing board and redefine the account signals and/or the points attributed to each one. If the close rate is higher while keeping a lower CAC, you know your account signals are the right ones to continue with. In essence, you have created a process to successfully identify accounts showing high intent to convert and monetize. Figuring out the right signals for buyer intent is part of your product’s defensible moat.

Lead separation and generation

A PLS motion relies on the self-serve product-led customer experience during acquisition and activation to feed into the high-touch sales-led monetization. In such a hybrid approach, product teams must identify and refine the appropriate account signals and share them with sales teams to help them understand who to contact and when.

Customers using self-serve products typically want to experience the features of your product to see whether it will help them solve a problem they have. During a high-touch sales process, customers can expect to learn the cost associated with product usage. The pricing model of a product strongly influences whether it should be self-serve or high-touch. If the business model is complicated and getting to the Aha moment takes a long time, then sales-led could be the right approach. On the other hand, if the pricing is related to product usage and reaching the Aha moment is simple for a user, then a predominantly self-serve approach might be best.

A typical behavior seen in sales-led products is chasing non-ICP customers just to close and meet their annual sales targets rather than identifying ICPs who can give them long-term growth through retention and monetization. When working under a PLS model, the incentives for sales teams must be centered around customer success over sales quotas (closing X number of accounts). Customer success revolves around retention and increasing customer value, measured through metrics such as churn and expansion revenue on high-growth accounts (closing low on accounts that later expand).

Shifting the focus from short-term to long-term signals incentivizes the right behavior within sales. They are now more likely to only contact PQAs late into their user journey after being equipped with onboarding data instead of a large number of unqualified accounts too early. A strong PLS motion exists at the intersection of product-led acquisition and activation, and sales-led monetization. This synergy depends on product teams working with sales teams to not just share PQAs but also product usage data and behavior.

Adam Fishman details, in this case study, how teams at Patreon used in-product onboarding hooks to collect information about what users were doing on the platform. They observed that creators who got an early sales touch were much more successful in terms of % engagement, number of fans, etc. The growth teams, once they had the onboarding data, then started contacting “high potential” creators as early in the user journey as possible, increasing engagement and the number of subscribed fans for creators. Using account engagement as a leading metric for churn helps you learn about the reasons, by reaching out to teams displaying a drop in engagement, and fix them. You can contact small teams immediately while for larger accounts, it may take weeks to get an understanding of the root causes.

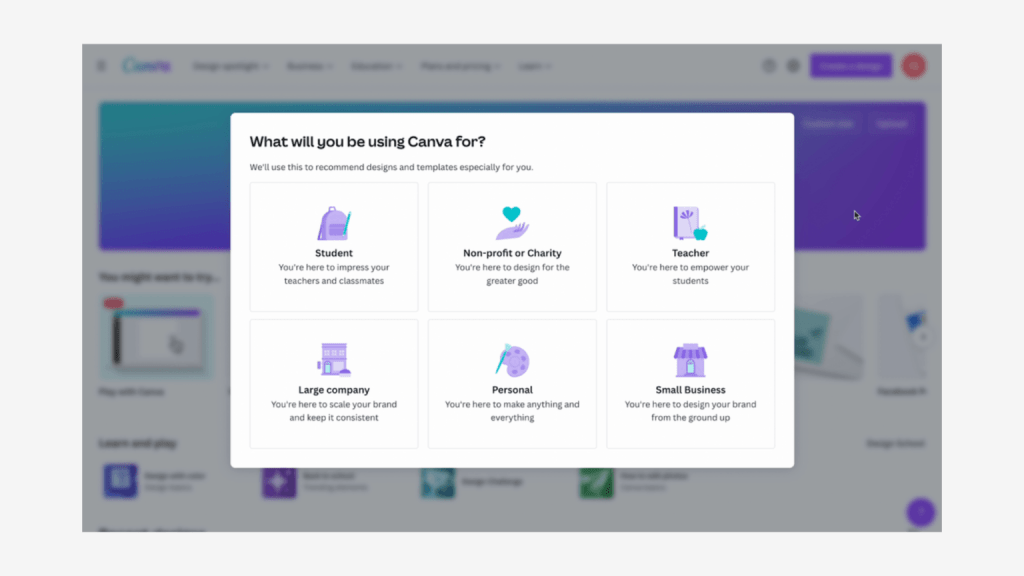

Many products use short and effective onboarding hooks to better understand and segment their users. Below is Canva’s current onboarding hook.

A heuristic for effective onboarding hooks is to contain what you want to ask in one screen/sentence, such as:

I am a ___ interested in ___ with a team size of ___.

Such onboarding data, coupled with the appropriate account signals, gives sales teams a better idea of who is more likely to monetize once they raise their hand for a sales touch.

Having multiple teams from the same company that use your product gives you an indication that there’s a possibility to upsell and consolidate them. It’s also a suggestion to adjust your onboarding flow to join teams from the same company (see the example below of how Canva does this). Miro and Canva are amongst the B2B2C SaaS products that successfully leverage this approach.

The more users you typically consolidate into a single account, the higher the account LTV is likely to be. By seeing other potentially relevant team rooms users can join, teams are more likely to increase engagement, helping your product become resilient to churn and downgrades. Eventually, such behaviors can help the product move upmarket.

PLS can be a powerful approach to combine the advantages of product-led and sales-led approaches, given the appropriate context and product. The first sales of any product should be done by the CEO/Founder so that they can get the insights first-hand and get a feel of the market (founder-led sales). A common antipattern includes “handing off” this responsibility to Sales too early, without appropriate product data.

By using PLS and qualifying accounts through behavior, you are less likely to encounter a leaky bucket. An often understated benefit of PLS is the internal collaboration that results from breaking silos and having departments work towards driving customer value. The next, and final blog post of this product-led series, dives into the specific growth models and tactics one can use to optimize PLG and PLS motions – such as freemium, trials, reverse trials, interactive demos, when to add friction, and when to use gated vs ungated approaches.

1 thought on “Product-led Sales (PLS)”