A go-to-market (GTM) strategy is a subset of a product strategy and is a set of decisions that allows the organization to gain a competitive edge in taking the product or service to market. These decisions include pricing, sales, cohort analysis, distribution channels, customer journey, (re)branding, and positioning. The set of choices an organization makes on the topics mentioned above serves as their data-informed hypothesis that the customers in the market will prove or disprove. Contrary to a strategy, a plan/roadmap is a list of activities to execute.

For example, a GTM strategy for expanding an orange export business into a new market (let’s say Germany) could include setting premium price targets for a specific cohort in Germany exclusively distributed through Aldi wholesalers. Your plan to test and execute the strategy could include conducting cohort behavior analysis in the top 3 urban and rural parts of Germany, comparing Aldi’s ROI for direct vs indirect marketing channels on similar products, creating a branding campaign, and so on.

An effective GTM strategy consists of the following inputs:

- Product – What is your product’s selling point? How does it differentiate itself from other products in the same category? What key business metrics are the product driving for your organization?

- Sales – Is your strategy to focus on B2B or B2C? What sort of service level agreements (SLAs) can you commit to? What are your pricing tactics?

- Marketing – Who is your target audience and what does their customer journey look like? What direct and indirect marketing channels are you using? How are you branding and positioning your product in the market?

Once you have input on the three core elements, you can create a more complete GTM strategy with some additional considerations.

Oatly is a great case study on the GTM topic. Founded in 1985 in Sweden, Oatly has become one of the most popular plant-based milk brands in the world. The origins of the company lie in Lund University where researchers were on a mission to combat lactose intolerance and unsustainable cow milk production. In the 1990s, Swedish food scientist Rickard Öste’s experimentation with oats led him to re-brand and re-launch the company as Oatly.

Instead of using traditional advertising channels such as media and print, Oatly went directly to the artisanal coffee shops across the US and positioned themselves as the go-to dairy milk alternative. Their timing couldn’t have been better as the rise of specialty coffee in the 2000s and 2010s coincided with that of alternative plant-based milk. Oatly continued to strengthen its relationship with baristas in different markets by introducing product lines such as Barista Blend. By having a strong presence in trendy, independent cafes, Oatly leveraged the power of network effects to fuel its growth in partnership with that of global third-wave coffee brands. Furthermore, Oatly’s witty marketing campaigns helped brand the company as funny, relatable, and creative. This further allowed them to connect with their target audience of younger individuals who share the same values – sustainability, creativity, and health-consciousness.

Traditionally, most GTM strategies include at least one of the four variations:

- Account-Based Marketing (ABM) – focuses on B2B sales through email and content marketing.

- Demand Generation – Marketing and Sales work together to build awareness of the product and generate demand through radio ads, cold calling, email campaigns, and conferences and fairs.

- Inbound – personalized the sales process for potential customers who have expressed interest through social media, SEO, newsletter subscriptions, or other content. Contrary to inbound sales, outbound sales representatives initiate communication with potential customers.

- Sales enablement – providing the Sales team with the resources they need to identify and close leads during the product rollout.

While the above components of GTM strategies can get the ball rolling on launching a new or existing product in a market, it is not enough to fuel sustainable growth. The most successful organizations invest in growth loops to create a cycle of self-reinforcing mechanisms driven by specific inputs and triggers from customers.

Growth Loops

I often use the Oatly case study to demonstrate the value of building growth loops in addition to classic sales funnels. In a sales funnel, the customer is expected to go through the classic stages of awareness, acquisition, activation, retention, revenue, and referral. However, the over-simplification of an unidirectional flow treats the customer as a one-time user. Especially in B2B products, where the focus often lies in building long-term relationships with partners and customers, the goal of growth loops is to continue providing the customer – and business – with additional benefits from other lines of products by having one area of a product feed into other areas. Growth loops can help create a self-reinforcing cycle of acquisition, engagement, and retention. Oatly understood this and leveraged their partnerships with independent cafes to get them hooked on oat milk and refer new customers.

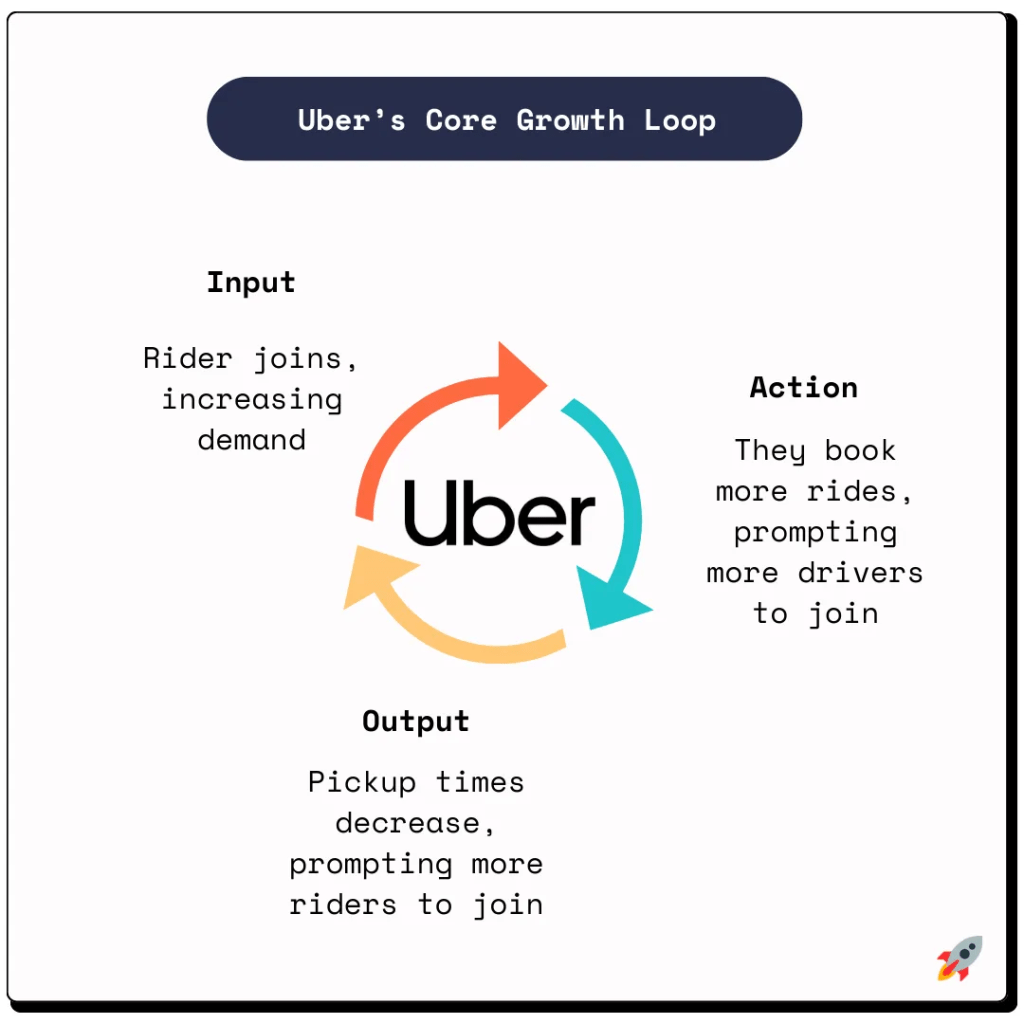

In essence, a growth loop can be simplified into the following steps:

Let’s explore the steps with an example from the Uber growth loop. Riders joining the Uber app and requesting rides trigger more drivers to join the app to cater to the demand, which in turn decreases the waiting time per ride, resulting in more users joining Uber via referral or word of mouth.

Meaningful acquisition measures

Does that mean Uber should focus a large chunk of their marketing budget on customer acquisition? Not quite… Lots of organizations try to optimize their customer acquisition costs (CAC), especially related to the customer’s lifetime value (LTV), which is the estimated revenue that the customer will generate throughout their lifespan. A CAC:LTV ratio of 1:3 is often used as a benchmark to measure the return on investment for the org on a customer. At first glance, this makes sense, especially as a lagging metric investors look at to see past performance. In practice, however, the following pitfalls exist when measuring LTV to predict future performance, because it is essentially a bunch of assumptions:

- If the assumptions are true, measuring LTV takes 5-15 years to materialize. Until then you have no indication of whether your upfront investment was worth it.

- You don’t know whether a majority of the customer value will materialize in the short term or long term. Therefore, you can’t plan your budget – often leading to sunk-cost fallacy.

- Even if a majority of the customer value was realized in the first 2 years, it isn’t indicative that the same will happen of the next 12 years. Market trends, new products, supply chain disruptions, biological and ecological disasters, and political challenges can drastically alter the world in a few months (i.e. Covid).

As a result, organizations struggle to identify appropriate CAC for their products. Adding another dimension to the conversation allows us to have a more realistic and helpful indicator – payback period (aka payback rate and payback velocity), which is the speed at which you recoup your CAC. Crafting your GTM strategy around payback period is much more observable in real-time. Lenny’s Newsletter details a heuristic for comparing payback period to industry leaders in the appropriate columns.

Building growth loops while looking at the payback period allows organizations to identify short- and medium-term investment opportunities for their product, while compounding long-term growth. While payback period is a good lagging indicator, exceptional products build in leading indicators to help them decide whether they should continue investing in a specific growth tactic or not.

In summary, build an effective GTM strategy with the following steps:

- Identify the details behind the three core elements of a GTM.

- Start with a classic sales funnel and its appropriate top/middle/bottom funnel metrics to visualize the customer journey.

- Identify opportunities for building growth loops in your product. Think about how the output of certain sections of your product can feed into the input of another (sub) product.

- Experiment, measure, and iterate. Brainstorm ways to measure the effectiveness of your product’s trigger, action, and output and split-test approaches, while focusing on the customer payback period and its leading indicators.

- Scale effective loops. Once a growth loop shows promise, double down and find ways to scale it such as expanding into other products, or directing a higher portion of your traffic into it.

Bear in mind that GTM strategies are typically for a single product line. As a product leader, especially at the VP level, you want to zoom out, look at the big picture, and ensure that the GTM of that specific product fits into the overall portfolio strategy. For example, it might not make much sense to take a mature product offering little benefits into a new market. On the other hand, if you have an aging cash cow (that’s still offering customer value) that you want to rejuvenate by taking into a new market, that would potentially limit investments in “question mark” and “star” product types, both of which could have high growth potential. Making such decisions and balancing the product portfolio must always be in line with the overall business strategy.

3 thoughts on “GTM Strategy & Growth Loops”